Many people set up and are using a living trust for real estate for estate planning purposes, primarily to avoid probate and save some estate taxes. However, most estate planning attorneys are not real estate savvy, and they recommend an awful strategy – title all your real estate in the name of your living trust!

Think about this… if you owned all your real estate in an LLC, at least your personal assets are protected from liability. If you title ALL your assets in a living trust, then your living trust can be sued for any liability caused by any asset, and lose EVERYTHING!

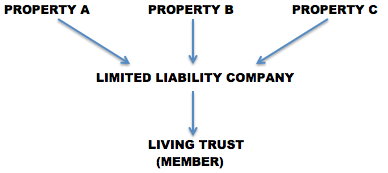

The proper way to use a living trust as a real estate investor, in my opinion, is to hold properties in various entities – LLCs, land trusts, FLPs, etc. Then, the entities are owned by the living trust. You accomplish the same thing, namely probate avoidance for your real estate, but your put a layer of protection between your assets and your living trust!

It might look something like this:

If your estate plan is old or outdated, seek the assistance of a qualified attorney who is versed in real estate to update your plan.