Is Your Business Compliant and Properly Setup to

Withstand Investigations, Lawsuits, and Audits?

Get Your Real Estate Business Compliance Audit and Find Out!

Dear Real Estate Entrepreneur,

If you are in the real estate business, you are subject to a myriad of rules, laws, regulations, and choices on how to run your operation. Whether you are flipping, wholesaling, landlording, partnering, and/or lending, there are rules that apply to your business that you may not be in compliance with. And, you may be paying more in taxes than you should!

It's rare to find a person with the experience and background in real estate, taxes, business, and legal knowledge who can review your business practices and setup to make sure you are running things properly. Well, you're in luck! I have 30 years' experience as a real estate and business lawyer, 28 years' experience as a real estate investor, and have owned and run over a dozen businesses with multiple employees. I have learned what works and what doesn't, had many successes (and some failures), and have helped hundreds of clients stay out of trouble in their business by learning to be in compliance with the laws that affect their business. I can do the same for you!

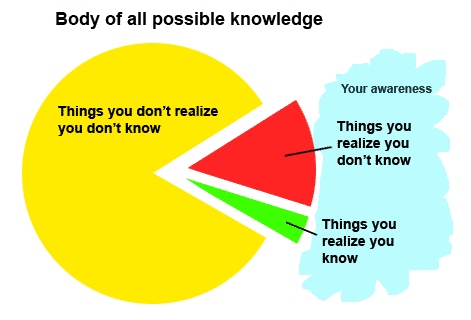

Blissful Ignorance is NOT a Smart Business Plan!

Smart business people have their companies routinely audited by consultants all the time, to make sure they are in compliance before the government or the courts examine if they are compliance. They do this because they want to find out the things that they DON'T KNOW that they DON'T KNOW!

Don't wait until an investigation, audit, or lawsuit before you discover what you are doing wrong!

Get Your Business Compliance Audit Done NOW!

For a flat fee of just $400.00, I'll review your business practices, including:

- Your marketing and advertising materials

- Your contracts for buying and selling real estate

- Your entity setup and tax structure

- Your rental and sales policies

- Your employee and contractor relationships

- Your plan for scaling and growing your business

I will then write you a report with recommendations for improving your business in all of these areas for legal, tax, and regulatory compliance, as well as suggestions for running things more efficiently and effectively.

Just a Few Examples...

Here are just a few examples of regulations you may be stepping on:

And there are many more issues you may not be aware in your business, so get your Business Compliance Audit done right away!

Here's How it Works...

Purchase the Business Compliance Audit Through the Checkout Button Below

Your investment in your peace of mind is just $400.00, which is a paltry sum compared to what

it could cost your in a government investigation, lawsuit, IRS audit, or other disaster!

Like the muffler man says, "You can pay me NOW, or you can pay me LATER!

Gather Your Items

You will receive a welcome email with a list of items we'll need to conduct your compliance audit. This may include marketing materials, contracts, brochures, online ads, website copy, and corporate documents, depending on the nature of your business.

Once we receive your materials, we will review them and prepare a report of findings and recommendations. This will take approximately one week from the time you deliver the requested materials.